The Dutch pharmaceutical market is changing fast. Community pharmacies are under increasing pressure from rising patient expectations, digital convenience, medicine shortages, and tighter margins—while distributors and manufacturers need smarter ways to grow sell-out and strengthen pharmacy engagement.

So the real question is no longer “How do we deliver product?”

It’s “How do we activate the pharmacy network to sell more consistently and confidently?”

In this article, we’ll explore why gamifying pharmaceutical distribution in the Netherlands can become one of the most effective ways to increase sell-out, improve product visibility, and drive stronger engagement at pharmacy level.

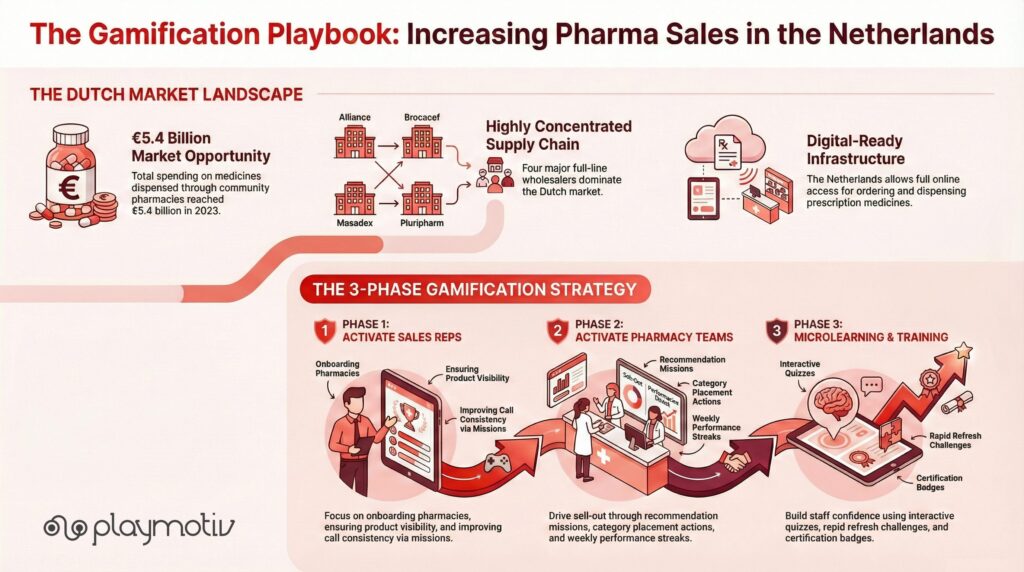

1) The Dutch pharmaceutical distribution sector is highly concentrated

The Netherlands has a compact but highly organised pharmaceutical supply chain. In practice, community pharmacies depend on a small number of key full-line wholesalers.

Today, four full-line pharmaceutical wholesalers cover the Dutch market with a complete medicine assortment: Alliance Healthcare, Brocacef, Mosadex and Pluripharm.

Alongside them, there are around 150 companies holding a wholesale licence, typically operating with limited assortments or specific procurement models.

This structure creates efficiency, but it also increases the competitive pressure for distributors and brands to stand out through service, activation, and value beyond logistics.

2) The “size” of the opportunity: pharmacies, patients and medication spend

To understand the potential, it helps to look at a few key figures:

-

The Netherlands has around 1,953 community pharmacies.

-

In addition, there are around 273 dispensing GP practices (apotheekhoudende huisartsen), mainly in areas with limited pharmacy access.

-

Spending on extramural medicines (dispensed via community pharmacies) reached €5.4 billion in 2023.

-

The number of users of extramural medicines rose to 11.8 million people in 2023.

-

For hospital/secondary care, spending on expensive intramural medicines was around €2.59 billion in 2023.

This is a market where small shifts in pharmacy behaviour can generate major impact—especially in OTC, self-care, adherence programs, and brand switching within guidelines.

3) Online access is already part of the game in the Netherlands

Unlike many EU countries, the Netherlands is one of the EU Member States that allow full online access to prescription medicines (ordering, dispensing, and delivery via authorised pharmacies).

That means pharmacies and distributors must compete not only on availability—but also on patient experience, speed, trust and service convenience.

4) How to increase sales in pharmaceutical distribution in the Netherlands

A) Innovate in services, not just products

The strongest distributors are evolving from “supply partners” into performance partners, supporting pharmacies with:

-

smarter assortment support

-

promotional activation

-

category growth plans

-

pharmacy staff engagement

-

training content and product confidence

When pharmacy teams feel confident, they recommend more. When they feel supported, they commit more.

B) Use data and technology to activate the point of sale

The Dutch market is mature and efficient—but also extremely competitive. Winning often comes down to visibility and execution:

-

clear focus products and campaigns

-

measurable behaviours at pharmacy level

-

fast feedback loops

-

personalised goals based on pharmacy potential

Technology makes this scalable. Motivation makes it actually happen.

5) The big growth lever: gamify your distribution network

Most sales teams want to do more—but the reality is that even in a compact country like the Netherlands, activating a full network takes enormous effort.

That’s why gamification is so powerful: it turns your commercial strategy into a structured, measurable and engaging experience for:

- sales reps and account managers

- pharmacies and their teams

- training + product knowledge adoption

What does it mean to gamify pharmaceutical distribution?

Gamification means applying game mechanics (missions, progress, rewards, levels, leaderboards) to non-game contexts—like training, sell-out activation, or product launches.

In Playmotiv terms:

you launch a campaign as a “game session” that motivates the network to take action, week after week.

A simple 3-phase gamification model for the Netherlands

Want to increase sales through pharmacy engagement?

If you want to drive sell-out in the Netherlands with measurable pharmacy activation, gamification is one of the fastest ways to scale engagement without increasing manual workload.